tax identity theft meaning

But this is where the trouble starts. A person who commits tax identity theft could be using your social security number to pretend to be you falsely claiming your dependents or using your.

Irs Notice Cp01s Message About Your Identity Theft Claim H R Block

How To Protect Yourself from Tax Identity Theft.

. The IRS will use algorithms that include common patterns of data matching to. A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR or payroll department. What is the Meaning of Tax Return Identity Theft.

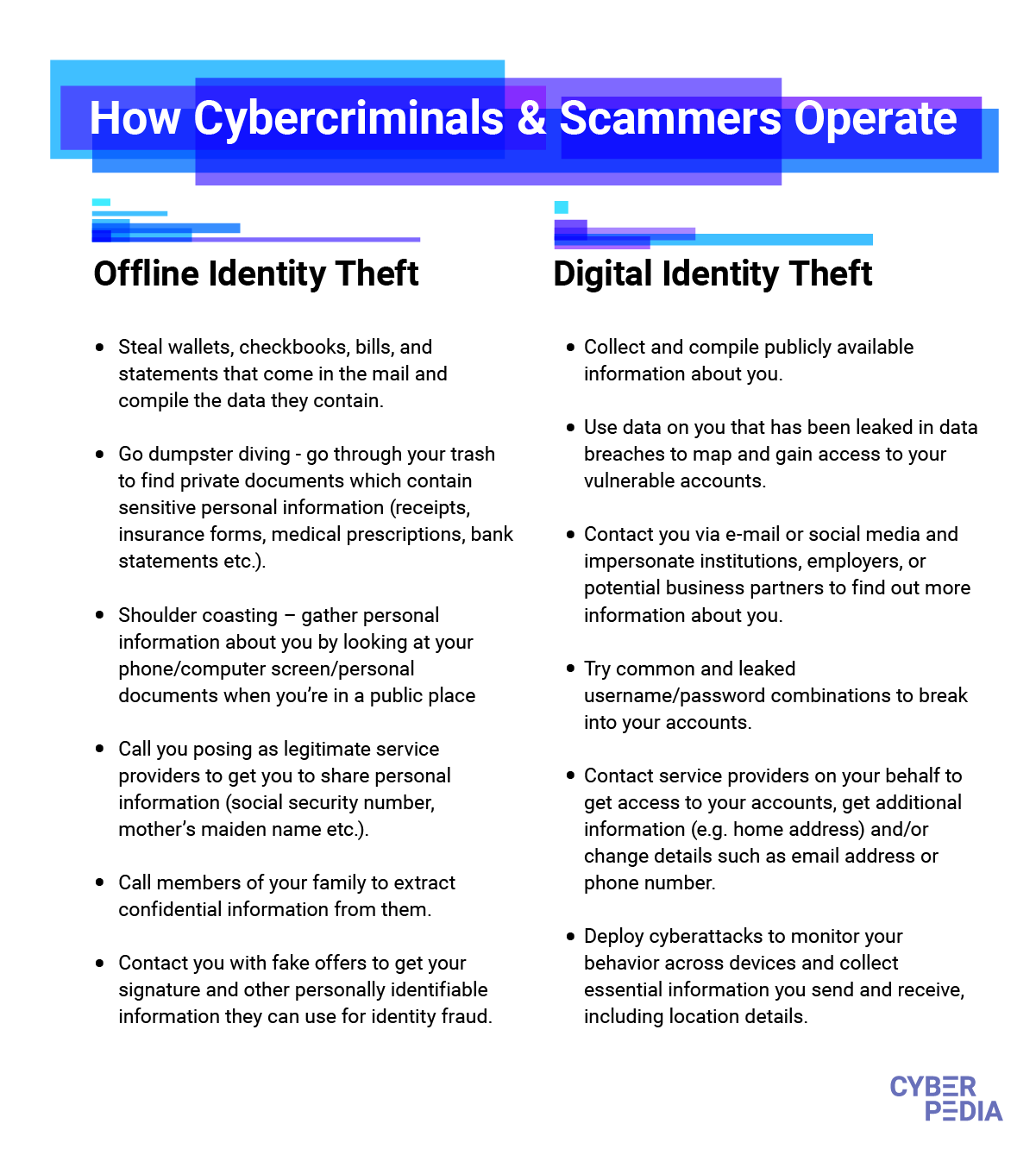

Get Score Planning Report Protection Tools Now. Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make transactions or purchases. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you.

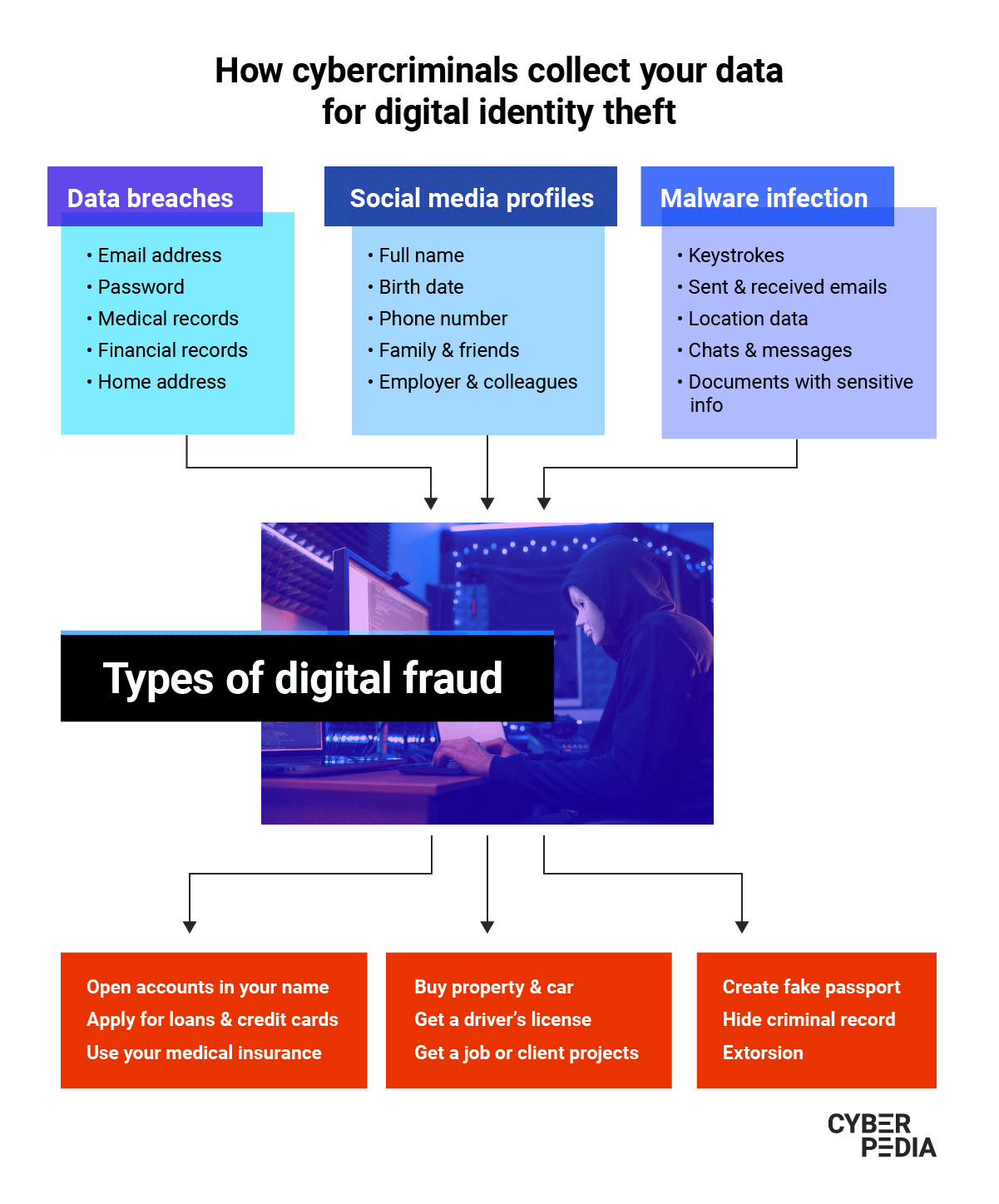

This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. One of the major identity theft categories is tax identity theft.

You might think youre in the clear because you report income from wages and other sources. This route gives them access to much more information than just one single person making it a much larger tax-related fraud scheme. The email would request files of W-2 forms of some or all of your companys employees.

The most common method is to use a persons authentic name address and Social Security Number to file a tax return with false information and have the resulting refund direct-deposited into a bank account controlled by the thief. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund.

Your Credit Can Too. Use Strong Authentication and Real-Time Access Policies to Grant Access to Resources. It is the 3rd largest theft of all federal funds after Federal Unemployment Benefits and Medicare.

Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

Tax return fraud is the act of filing a return employing a stolen identity and taking the victims refund. More from HR Block. This kind of fraud is equipped with three simple ingredients.

This offense in most circumstances carries a maximum term of 15 years imprisonment a fine and criminal forfeiture of any personal property used or intended to be used to commit the offense. And while a swiped refund may seem like a worst-case scenario. If your wallet or other personal information is stolen or you are a victim of a data breach your personal information may be used to commit tax-related identity theft.

Taking steps to protect your personal information can help you avoid tax identity theft. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. Ad Prevent Identity Theft With An IDShield Protection Plan.

Tax identity theft happens when someone uses your personal information to file a tax return claiming the fraudulent returns are yours. Tax identity theft is a form of financial identity theft and occurs when an individual steals your personal information to file fraudulent tax returns either with the IRS or with a state. These acts can damage your credit status and cost you time and money to restore your good name.

The thief in this case can. Get 247 Live Member Support and Protect Your Identity. A reputation birth.

ID theft through a tax professional. A reputation birth. Ad Our Technology Alerts You to a Wide Range of Identity Threats.

People often discover tax identity theft when they file their tax returns. Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft. Schemes to commit identity theft or fraud may also involve violations of other statutes such as identification fraud 18 USC.

Heres what you can do to. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. More from HR Block.

Basically its identity theft plus tax fraud. Ad Guard Against Breaches of Lost or Stolen Credentials with Password Protection. In situations where a taxpayer makes an allegation of identity theft or when the IRS initially suspects that identity theft may have occurred IRS functions will apply an identity theft indicator.

This kind of fraud is equipped with three simple ingredients. Sign Up For A Plan Now. Equipped with three simple ingredients a name birthdate and Social Security number the thief can commit tax fraud resulting in delayed or stolen refunds.

For tax-preparing software and systems a. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. It is the 3rd largest theft of all federal funds after Federal Unemployment Benefits and Medicare.

Tax return fraud is the act of filing a return employing a stolen identity and taking the victims refund. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one. There are a lot of ways ones identity can be stolen.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. 1028 credit card. Then theyd attempt to file fraudulent tax returns to.

Get 3-Bureau Credit Monitoring With Identity Protection. Identity ID theft happens when someone steals your personal information to commit fraud. Ad Nows the Time to Put a Powerful Credit Plan in Place with TransUnion.

What is the Meaning of Tax Return Identity Theft. Enroll in Minutes Now. Using all 3 will keep your identity and data safer.

The identity thief may use your information to apply for credit file taxes or get medical services.

What Is Identity Theft Webopedia Reference

What Is Identity Theft Definition Bankrate

Quotes About Identity Theft 36 Quotes

Learn About Identity Theft Chegg Com

What Happens After You Report Tax Identity Theft To The Irs H R Block

What Is Identity Theft Definition From Searchsecurity

What Is Digital Identity Theft Bitdefender Cyberpedia

Irs Notice Cp01 Identity Theft Claim Acknowledgement H R Block

What Is Digital Identity Theft Bitdefender Cyberpedia

Identity Theft Definition What Is Identity Theft Avg

Dark Web Monitoring What You Should Know Consumer Federation Of America

Tax Identity Theft American Family Insurance

Types Of Identity Theft And Fraud Experian

Irs Notice Cp01c We Verified Your Identity H R Block

Tax Identity Theft American Family Insurance

Learn About Identity Theft Chegg Com

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)